What is OBPP ?

Online Bond Platform Providers (OBPP) facilitate the buying, selling, and management of fixed income investment products such as Bonds and SDIs, making the investment process accessible and easy for retail and institutional investors

No. of OBPPs

29

Investments Enabled

10,000+ Cr

Steps to Become a Member of OBPP Association

1. Download the Form

Visit the OBPP Association website and download the membership form.

2. Fill Out the Form

Complete the form with your company’s details and contact information.

3. Submit Required Documents

Business registration certificate

BSE / NSE Members

SEBI registration / license

OBPP registration / license

Proof of compliance with regulations

Any relevant certifications

5. Review Process

Your application will be reviewed, and you’ll receive an email with further documents if approved.

6. Pay Fees

Upon approval, pay a one-time admission fee of INR 5,00,000 and an annual membership fee of INR 2,00,000 (recurring every year).

What are Debt Instruments?

Debt instruments are financial tools used by governments, corporations, or other entities to raise capital by borrowing money. In essence, they are contracts between the borrower (issuer) and the lender (investor), specifying that the issuer will pay back the borrowed funds with interest over a predetermined period. Below are examples of Debt instruments

Types of Debt Instruments

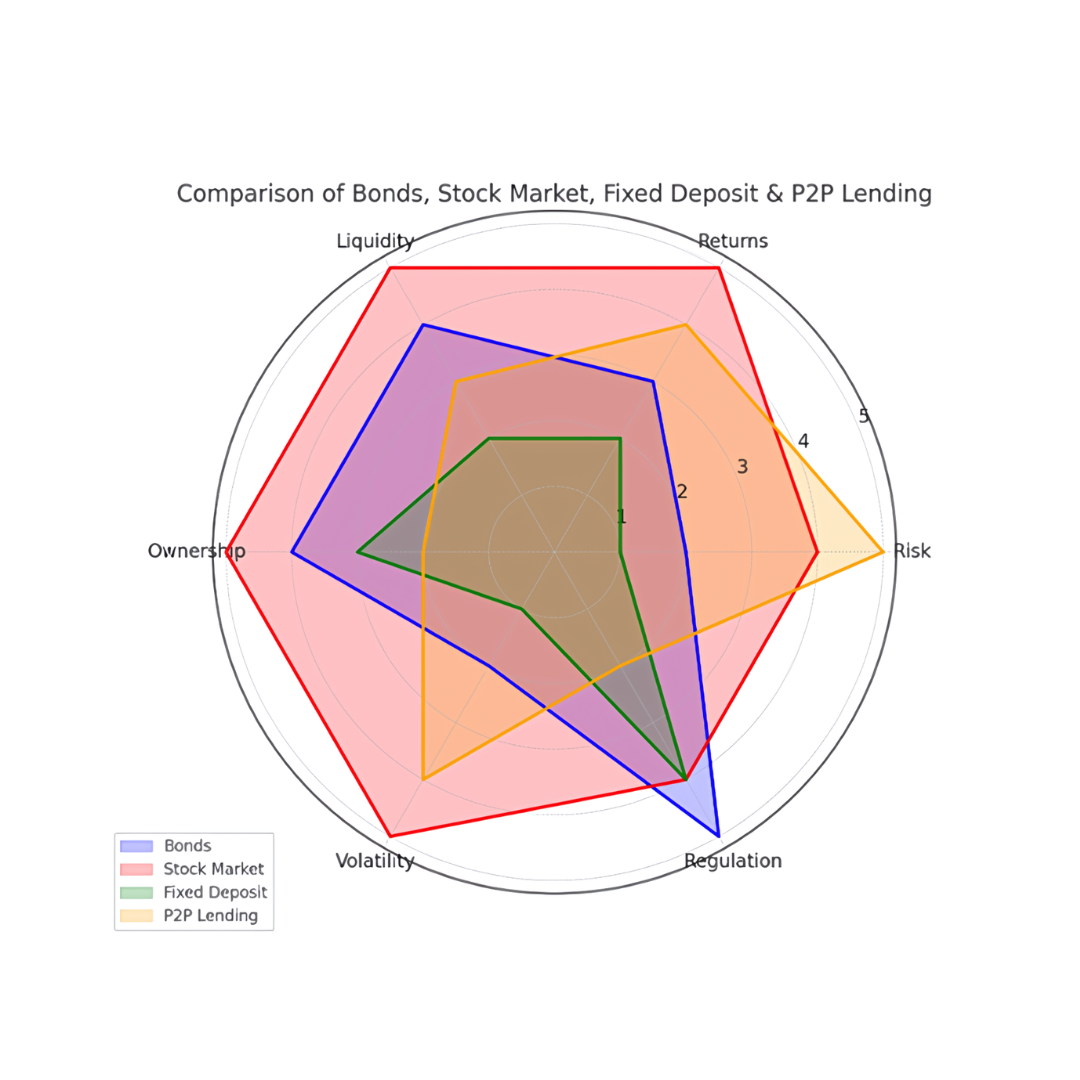

Comparison to Stock Market, Fixed Deposit & P2P

Executive Committee

Press Release

Online bond platform companies set up industry body

Important Announcement

Unlock the power of

stable returns.